IndiaFirst Life Ensures a Simplified Investment

Journey for NRIs

As an NRI, your family’s financial security is your primary concern. One of the simplest and most secure solutions is Life Insurance. A life insurance policy for NRI in India can fulfill all your responsibilities such as children’s education, creating a regular income for dependents, growing wealth, or retirement planning. Depending on your requirement, you can choose from a range of savings plans that are designed to meet your goals.

Get Insurance Plans That Best Suit Your Goals

Your search for an ideal investment option ends with IndiaFirst Life Insurance’s smart and innovative plans created especially for you.

IndiaFirst Life

Guaranteed Pension Plan

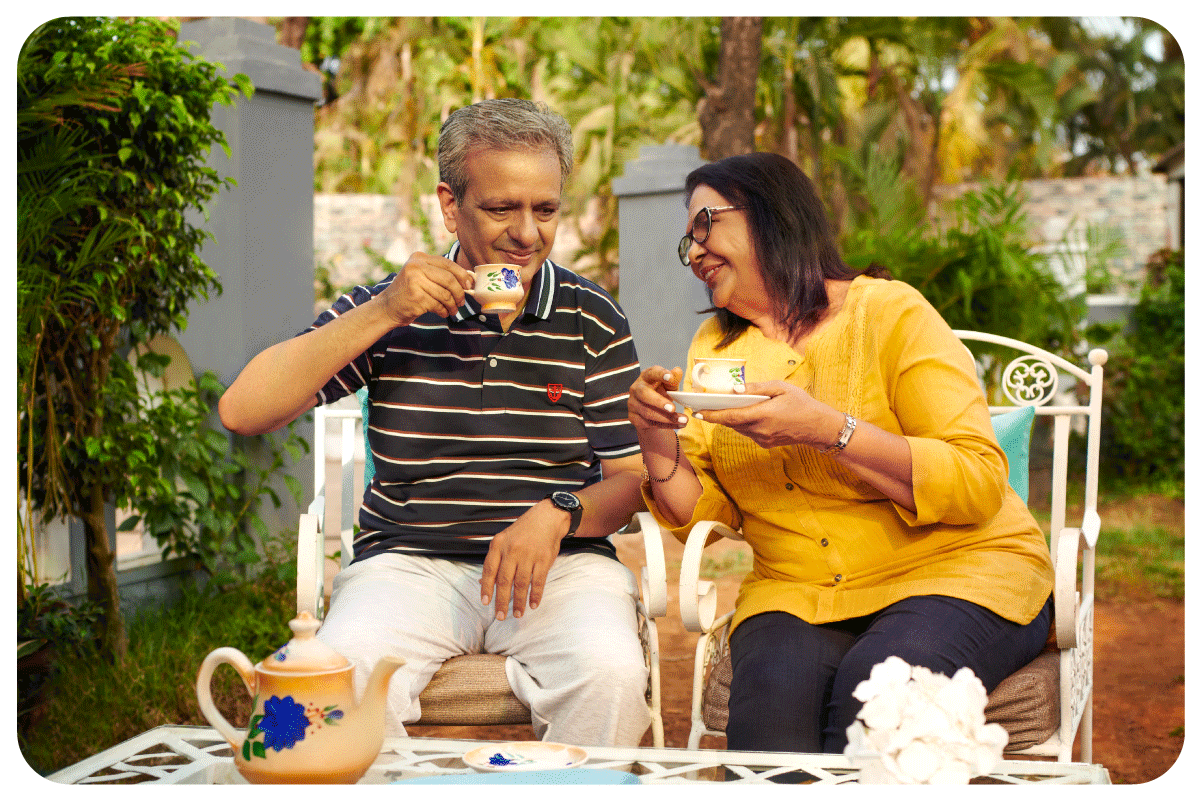

Spend more time with your family, play with your grandchildren, and plan a wonderful date with your life partner. We characterize your retirement phase in such a way as we guarantee* a life of peace and tranquillity... You pay for limited period and enjoy annuity benefits of policy for a lifetime. Choose from 5 different annuity options as you create the assurance of a lifetime of income. Stay protected from 20 Critical Illnesses as you get the amount to utilize for your treatment. Avail the Return of Purchase Price facility and protect your nominee(s) as they get back the premium amount in case of any uncertainty. This plan has a Joint Life Option which allows you to extend your annuity benefits to your partner.

IndiaFirst Life

Radiance Smart Invest Plan

Our ULIP plan is an ideal way to build wealth and secure your loved ones. This plan is designed to provide financial protection to you and your family through insurance cover and marked-linked returns. ... You can build a corpus of wealth by investing in market-linked fund options with six versatile investment strategies to meet your unique financial goals. Take advantage of 10 robust fund options with unlimited free switches as per your needs. You receive the fund value on maturity. In case of your premature death, your family receives the highest pay out, i.e., Sum assured or 105% of the total premiums paid as on the date of receipt of intimation of death of the life assured. This ULIP plan for NRIs offers you the unique combination of wealth creation plus family safety.