Protect your Family’s

Happiness & Future

IndiaFirst Life

Guaranteed Protection Plus Plan

(Non-Linked, Non-Participating, & Individual Term Insurance Plan)

Life Cover + Tax Benefit** + Waiver of Premium Add-On1

Pay for 5 years and get covered for 99 years

Key Benefits of IndiaFirst Life

Guaranteed Protection Plus Plan

All of us desire to protect our family under all circumstances. Yet, life can be unpredictable. But by planning for your family’s financial protection now, you can secure their dreams and happiness irrespective of any untoward event.

Get whole life coverage with an option of paying premiums for only a short duration (Limited premium).

Pay Only For 5 Years And Get Cover Till 99 Years Of Age

Life Option also lets you insure your spouse in the same policy for an additional cover that is 50% of your sum assured.

Insure Your Spouse Under The Same Policy

Pay premiums monthly, quarterly, half-yearly, yearly premium under Limited premium or a single premium at your convenience

Premium Payment As Per Your Convenience

Avail Return Of

Premium Option

The Return of Premium option lets you receive all your premiums back upon outliving the policy tenure as a maturity benefit.

Waiver Of

Premium Benefit

In Life and Smart Life Option, future premiums will be waived off if you are diagnosed with any of the listed 40 Critical Illnesses or suffer permanent disability in an accident with minimal additional premium.

Additional 6% Discount For Partner Bank And Indiafirst Life Employees

Enhance your financial protection with an additional 6% discount if you are an IndiaFirst Life employee or a Partner Bank.

(For Limited Premium Payment Option)

Pay Only For 5 Years And Get Cover Till 99 Years Of Age

Get whole life coverage with an option of paying premiums for only a short duration (Limited premium).

Insure Your Spouse Under The Same Policy

Life Option also lets you insure your spouse in the same policy for an additional cover that is 50% of your sum assured.

Premium Payment As Per Your Convenience

Pay premiums monthly, quarterly, half-yearly, yearly premium under Limited premium or a single premium at your convenience.

Avail Return Of Premium Option

The Return of Premium option lets you receive all your premiums back upon outliving the policy tenure as a maturity benefit.

Waiver Of Premium Benefit

In Life and Smart Life Option, future premiums will be waived off if you are diagnosed with any of the listed 40 Critical Illnesses or suffer permanent disability in an accident with minimal additional premium.

Additional 6% Discount For Partner Bank And Indiafirst Life Employees

Enhance your financial protection with an additional 6% discount if you are an IndiaFirst Life employee or a Partner Bank.

How Does The

Guaranteed Protection Plus Plan Work?

Mr.Rahul

Age 35

Rahul, aged 35, works in a multinational company. He lives with his wife and 2-year-old son.

He purchases the

IndiaFirst Life Guaranteed Protection Plus Plan with Return of Premium Option

He has taken a Sum Assured of INR 2 Crore and opted for cover till age 85 years. He pays an annual premium of INR 2,80,820 (exclusive of GST) for 5 years and opts for a lump sum payout option. He is underwritten as a Standard life by IndiaFirst Life during policy issuance

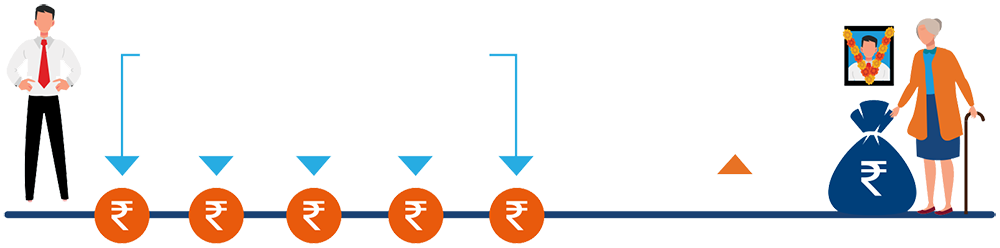

Scenario 1:

At the age of 55, Rahul unfortunately passes away. A lump sum benefit of INR 2 Crore is paid out to his family members (Nominee) which will help them maintain their current lifestyle and fulfil their goals.

Total premiums paid by Rahul – INR 14,04,100 (exclusive of GST)

Total benefits received by the nominee 2 Cr.

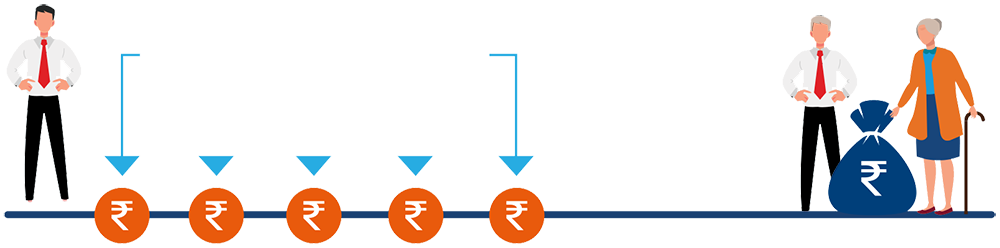

Scenario 2:

Rahul survives till the end of the policy term.

He receives 100% of his premiums^ back which is equal to INR 14,04,100

Total premiums paid by Rahul – INR 14,04,100 (exclusive of GST)

How To Buy

Guaranteed Protection Plus Plan Online

STEP 1

Get Quote

STEP 2

Choose Plan Options

Life Option

Add-ons you can opt for:

- Waiver of Premium Benefit

- Joint Life Option

Smart Life Option

Add-ons you can opt for:

- Waiver of Premium Benefit

Return of Premium Option

STEP 3

Make Payment

Why Choose IndiaFirst Life?

Partnered with India's second largest PSU

Bank of Baroda

Number of Lives Insured

1.4 Cr.

Claim Settled Ratio

98.04%

Bank Branches Across India

8.4K +

Awards & Recognition

INDIA’S BEST 100 COMPANIES TO WORK FOR 2022

THE ECONOMIC TIME'S BEST BRAND - 2021

TOP 100 | INDIA'S BEST WORKPLACES FOR WOMEN

Explore Guaranteed Protection Plus Plan

FAQs: Answers To Your Queries

IndiaFirst Life Guaranteed Protection Plus Plan is a Non-Linked, Non-Participating, Individual Pure Risk Premium, Life Insurance Plan, designed to ensure financial well-being of your family in case of any untoward event/s.

| Criteria | Minimum | Maximum |

|---|---|---|

| Entry Age (as on last birthday) | 18 years; | Life Option & Return of Premium - 65 years Smart Life Option - Age at which benefit decreases less 5 years |

| Premium Yearly | Rs. 2,400 | No limit subject to Board approved underwriting policy |

| Half Yearly | Rs. 1,200 | |

| Quarterly | Rs. 600 | |

| Monthly | Rs. 200 | |

| Single | Rs. 100 | |

| Premium Paying Term (PPT) |

For Single Premium: One-time payment at policy inception For Limited Premium: As per table mentioned below |

|

| Coverage Option | Premium Paying Term (PPT) - For Limited Premium |

|---|---|

| Option 1: Life Option | Minimum 5 years to maximum 47 years such that the maximum age at end of PPT is 70 years |

| Option 2: Return of Premium Option | 5/7/10/12/15/20/25/30/35 years such that the maximum age at end of PPT is 70 years |

| Option 3: Smart Life Option |

Minumum Policy Term

| Coverage Option | Minimum Policy Term | Maximum Policy Term | ||||

|---|---|---|---|---|---|---|

| Limited Premium | Single Premium | Limited Premium | Single premium | |||

| Option 1: Life Option | 10 years | 1 month | 81 years | 20 years | ||

| Option 2: Return of Premium Option | 10 years | 10 years | 67 years | 20 years | ||

| Option 3: Smart Life Option | 10 years | 10 years | 81 years | 20 years | ||

For coverage options 1, for single premium policies, the policy term allowed are at

monthly intervals till 24 months, quarterly intervals from 24 months till 60 months and

yearly intervals thereafter.

For coverage options 3, the policy term chosen should be such that the reduced benefit is applicable for atleast 6 years.

The combination of premium paying term and policy term available for Limited premium

paying policy are as follows:

| Premium Paying Term (PPT) | Minimum Policy term | Maximum Policy term |

|---|---|---|

| For coverage option 1: | As per the option chosen in the table above | |

| 5 years to 47 years | PPT+ 5 years | |

| For Coverage Option 2: | ||

| 5 years | 10 years | |

| 7 years | 10 years | |

| 10 years | 15 years | |

| 12 years | 15 years | |

| 15 years | 20 years | |

| 20 years | 25 years | |

| 25 years | 30 years | |

| 30 years | 35 years | |

| 35 years | 40 Years | |

| For Option 3 | ||

| 5 Years | PPT+ 5 years | |

| 7 Years | ||

| 10 Years | ||

| 12 Years | ||

| 15 Years | ||

| 20 Years | ||

| 25 Years | ||

| 30 Years | ||

| 35 Years |

Maximum Maturity Age:

| Coverage Option | Maximum Maturity Age |

|---|---|

| Option 1: Life Option | 99 years last birthday |

| Option 2: Return of Premium Option | 85 years last birthday |

| Option 3: Smart Life Option | 99 years last birthday |

| Coverage Option | Minimum Sum Assured | Maximum Sum Assured |

|---|---|---|

| Option 1: Life Option | Rs. 50,00,000 | No limit, subject to BAUP |

| Option 2: Return of Premium Option | Rs. 25,00,000 | No limit, subject to BAUP |

| Option 3: Smart Life Option | Rs. 75,00,000 | No limit, subject to BAUP |

The life assured has the option to pay monthly, quarterly, half yearly, yearly premium under limited premium, or a single premium in the policy. Premium will vary depending upon the coverage option chosen.

Customer to choose the sum assured subject to minimum Sum Assured conditions and maximum death Sum Assured will be as per Board approved underwriting policy. Premium will be calculated on the basis of Sum Assured chosen. Please refer to the eligibility criteria mentioned above (Point 2) for more details.

There are 3 coverage options to choose from at policy inception. Coverage option once selected cannot be changed at a later date. Your premium will vary depending upon the option chosen by you.

- Life Option

- Return of Premium Option

- Smart Life Option

You can select any of the below given payout options at the inception of the policy.

Lumpsum Option:

The benefit on death or diagnosis of terminal illness, whichever is earlier, is payable as lumpsum and the policy terminates.Lumpsum and Level Income Option

On death or diagnosis of terminal illness, whichever is earlier, the policyholder can choose 10 % to 50% (in multiple of 10%) of the applicable death benefit to be paid immediately as lumpsum and the balance amount to be paid in arrears as equal monthly instalments over a period of 5 years. The lumpsum percentage has to be chosen at the inception of the policy.- This option shall only be available under Life Option

- Sum Assured can be increased without any medical underwriting on any of the below specified events during the life of the Life Assured. The total increase in Sum Assured shall be subject to overall limit of 100% of initial Sum Assured.

- The option to increase Sum Assured can be availed within a period of six months from the date of the specified events. The increase in Sum Assured will be effective from the annual policy anniversary falling immediately after the date of notification and an additional premium will be charged for an increase in the Sum Assured based on the attained age of the policyholder at the option exercise date.

- To exercise the above options life assured should be underwritten at standard rate at policy inception, the policy should be premium paying at the time of exercising the option and age of the policyholder must be less than 45 years. This option is not allowed for single premium policies.

| Life Stage Events | Maximum additional % of Base SA | Maximum Additional SA allowed |

|---|---|---|

| Marriage (only one instance during Policy Term) | 50% | 50 Lakh |

| Birth/ Legal adoption of 1st child | 25% | 25 Lakh |

| Birth/ Legal adoption of 2nd child | 25% | 25 Lakh |

| Home loan taken by Life Assured (only one instance during Policy Term) | 50% or loan amount (whichever is lower) | 50 Lakh |

- Sum Assured can be reduced in future if it had been increased during an event beforehand and post attaining age 45 years. This option is also applicable only under Life Option.

- The decrease will be allowed to the extent of Sum Assured increased under the specified event in the life of the Life Assured.

- The reduction in Sum Assured will be effective from the annual policy anniversary falling immediately after the date of notification and the premium will be decreased at the same time.

- The decrease in premium corresponding to the specified event of increase will be equal to the additional premium charged at the time of increase in Sum Assured benefit corresponding to that specific event as mentioned in the option to Increase Sum Assured.

- The option to decrease sum assured benefit cannot be availed by the policyholder during the last 5 policy years.

- Once sum assured is decreased it cannot be increased in future.

The written request for reduction in Sum Assured should be sent at least two months prior to the annual policy anniversary.

This is an optional benefit, available only with Life Option & Smart Life Option. All future premiums shall be waived if the Life Assured is diagnosed with any of the listed 40 Critical Illnesses or total permanent disability due to accident. An additional premium will be charged for this benefit. If Joint Life Option is chosen along with this option then WOP is applicable only on the primary life assured.

Yes, you can cover your spouse along with yourself under the same policy. You can do this by opting Joint Life Option. This option is available only with Life Option. Insurance coverage as chosen commences on both the Life Assureds’ at inception of the policy. If this option is chosen, an additional cover of 50% of Primary Life’s Sum Assured will be offered to the spouse upto a max of INR 1Cr cover. On occurrence of death of the secondary life assured, applicable benefit shall be payable. In case payout happens for a life assured, policy will continue for the other life assured till benefit for both the life assureds’ is exhausted or till the end of policy term, whichever is earlier.

Maturity Benefit is only applicable in case Return of Premium Option is chosen. On survival of the life assured till the end of the policy term, Maturity Benefit as applicable shall be paid to the Policyholder. The policy terminates once the full amount of benefit is paid on occurrence of the event.

No maturity benefit is applicable under any of the other plan options

Tax benefits may be available on premiums paid and benefits receivable as per prevailing Income Tax Laws. These are subject to change from time to time as per the Government Tax laws. Please consult your tax consultant before purchasing this policy.

No, loan is not allowed in this policy.

In the event of non-payment of premium due under the policy within the grace period the policy will lapse. The cover will cease and no further benefits will be payable in case of a lapsed policy.

We provide you with a grace period which is the time provided for payment of premium from the premium due date during which the policy is considered to be in-force with the risk cover. For Limited Premium policies, you are provided a Grace Period of 15 days under monthly mode and one month but not less than 30 days for other premium payment modes, in case you miss your due premium on the due dates. All your policy benefits continue during this grace period and the policy will be considered to be in-force.

Yes, you may surrender this Policy during the Policy Term, by submitting a written request to us any time after the Policy has acquired the Surrender/Termination Value. Please remember, you cannot revive your Policy once it is surrendered/terminated.

Yes, you can return your policy within the Free Look period; In case you do not agree to the any policy terms and conditions, you have the option of returning the policy to us stating the reasons thereof, within 15 days from the date of receipt of the policy. The free-look period for policies purchased through distance marketing or electronic mode will be 30 days.