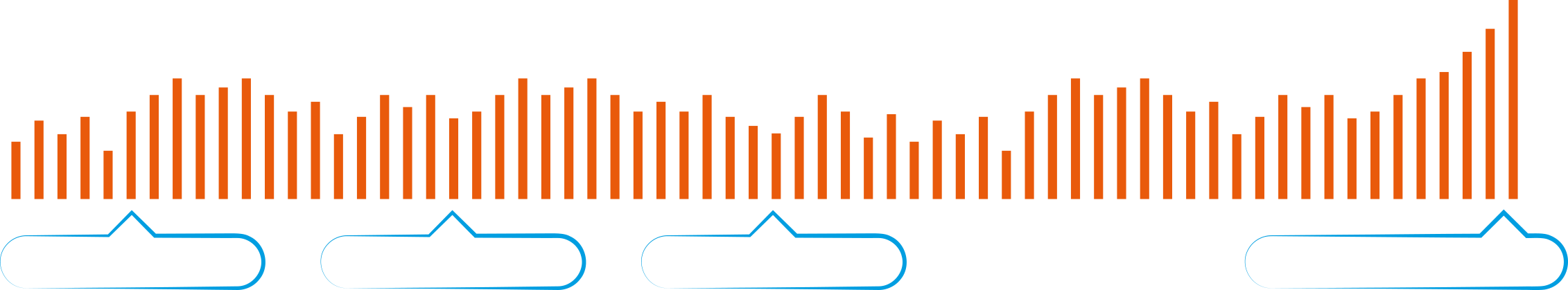

He further optimised his investments by selecting the Defined Allocation Strategy.

He chose Dynamic Asset Allocation (30%), Flexi Cap Equity (25%), Sustainable Equity (25%) and Equity Elite Opportunities (20%) as 4 fund options in the strategy.

In ULIP Plan, the investment risks in the investment portfolio is borne by the policyholder

A Unit Linked, Non-Participating, Individual Life Insurance Endowment Plan

Zero admin + premium allocation charges

Return of mortality charges + a % of annualized premium on maturity*

Free unlimited fund switches

Option to choose from 10 flexible funds

Premium waiver benefit with life cover

Market linked return benefits

Choose from 6 investment strategies based on your needs

Tax benefits* under sections 80C and 10D

A plan that is designed to enhance your family's financial security through insurance coverage and maximum returns.

In case of your unexpected demise, all future Premiums are waived off and the policy benefits continue to support your family till maturity.

Your family receives the Claim Amount in case of your demise during the policy term.

Receive the Fund Value on maturity even when you outlive the policy term.

In case of your demise, your family receives the highest Pay Out, i.e., Sum Assured or 105% of the total Premiums paid as on the date of intimation.

Life Cover during the entire policy term.

Fund Value payable on survival to maturity of the policy.

In case of accidental demise of the Life Assured, an additional amount equal to the Sum Assured subject to a maximum of Rs.1,00,00,000 shall be payable, provided the Accidental Death Benefit in the policy has not been discontinued prior to death, in addition to Death benefit as mentioned in the life option, and the policy will terminate.

Life Cover during the entire policy term.

Fund Value payable on maturity of the policy irrespective of survival.

In case of demise of the Life Assured, the higher of the following will be payable and the policy will terminate:

Sum Assured less partial withdrawals made during two years immediately preceding the demise of the life assured, as on the date of receiving intimation of demise; or Fund Value as on the date of intimation of demise of the Life Assured by us.

IndiaFirst Life

Radiance Smart Invest Plan

He invested in the Family Care Shield Option for the policy and premium payment term of 40 years.

He opted to pay an annual regular premium of INR 2,50,000 for a Sum Assured of INR 25,00,000 in the policy.

He chose Dynamic Asset Allocation (30%), Flexi Cap Equity (25%), Sustainable Equity (25%) and Equity Elite Opportunities (20%) as 4 fund options in the strategy.

The strategy ensured that his funds were rebalanced in the proportion mentioned by him every 6 months to enhance his savings.

At the end of policy term, he will receive a fund value of and help him achieve his goals.

IndiaFirst Life is one of the fastest-growing private life insurance companies in India with an aim to make insurance easily accessible to every Indian household. IndiaFirst Life is working closely with the Bank of Baroda and Union Bank of India, two of the largest public sector banks in India. IndiaFirst Life delivers value through initiatives stemming from the #CustomerFirst policy.

We have answered the most common questions about IndiaFirst Life Radiance Smart Invest Plan. Learn more about how this plan can work for you!

| Parameters | Minimum | Maximum |

|---|---|---|

| Age at Entry | (91 days) 0 years for Plan Option 1 18 years for Plan Option 2 & 3 | 65 years for all Plan Options |

| Age at Maturity | 18 years | 99 years |

| Parameters | Minimum | Maximum |

|---|---|---|

| Regular pay | 10 years | 99 - Age at Entry 99 - years for Life Plan Option 81 years for Extra shield & Family care option |

| Limited pay | 10 years 15 years 20 years 25 years |

20 years 20 years 30 years 30 years |

| Single pay | 10 years | 34 years |

| PPT | Minimum Policy Term |

|---|---|

| 5 | 10 |

| 7 | 10 |

| 10 | 15 |

| 15 | 20 |

| 20 | 25 |

| Annualized Premium (RP/ LP) | Single Pay |

|---|---|

| INR 48,000 | INR 2,50,000 |

You can choose the option of Systematic Partial Withdrawal after completion of first 5 policy years provided life assured is 18 years and above. You can choose this option either at the proposal stage or place a subsequent request after policy issuance. In either scenario, you need to choose the percentage of pay out and meet viability conditions as follows:

The systematic partial withdrawal amount should not be less than Rs.1000 and not more than 20% p.a. of the fund value at a monthly, quarterly, half-yearly or yearly frequency after completion of first 5 policy years. The fund value should not fall below 110% of one annual premium for regular/limited premium paying policies and should not fall below Rs. 100,000 for single premium at any time during the tenure of Systematic Partial Withdrawal assuming a gross investment return of 4% p.a, provided premiums are paid as and when due.

You can choose the option of Systematic Partial Withdrawal after completion of first 5 policy years.

18 years and above

Tax benefits may be available as per prevailing tax laws.