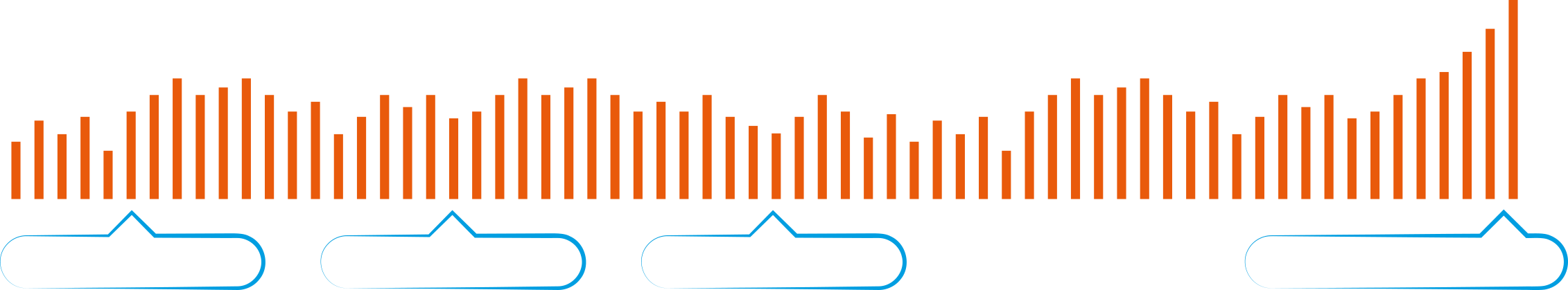

He further optimised his investments by selecting the Defined Allocation Strategy.

He chose Dynamic Asset Allocation (30%), Flexi Cap Equity (25%), Sustainable Equity (25%) and Equity Elite Opportunities (20%) as 4 fund options in the strategy.

In ULIP Plan, the investment risks in the investment portfolio is borne by the policyholder

Zero admin + premium allocation charges

Return of mortality charges + a % of annualized premium on maturity*

Free unlimited

fund switches

Option to choose from 10 flexible funds

Premium waiver benefit with life cover

Market linked return benefits

Choose from 6 investment strategies based on your needs

Tax benefits* under sections 80C and 10D

Life is unpredictable. And being a parent, it is always a goal to ensure the safety of your child's future even in your absence. The best way to achieve this goal is to buy a child savings plan for your children, which leads them to a peaceful and financially secure future. Some of the important reasons why you should choose a child savings plan are mentioned below:

A child savings plan allows your child to choose his/her career without seeking financial help from outside.

A child's career choices change from time to time. And it can put financial pressure on parents. A child saving plan works as a support system for your child's education so that they can follow their passion.

In case of untimely death, future premiums are waived, which means that the child does not have to worry about premiums in the absence of the policyholder.

In case of the uncertain demise of the policyholder during the policy term, the family receives the claim amount. So that your child does not have to compromise on his future aspirations.

Proper financial planning for the child's future can help the parents to lead a stress-free life after retirement as they do not have to work post-retirement to meet the financial needs of the children.

Life is unpredictable. And being a parent, it is always a goal to ensure the safety of your child's future even in your absence. The best way to achieve this goal is to buy a child savings plan for your children, which leads them to a peaceful and financially secure future. Some of the important reasons why you should choose a child savings plan are mentioned below:

IndiaFirst Life Radiance Smart Invest Plan

He invested in the Family Care Shield Option for the policy and premium payment term of 40 years.

He opted to pay an annual regular premium of INR 2,50,000 for a Sum Assured of INR 25,00,000 in the policy.

He chose Dynamic Asset Allocation (30%), Flexi Cap Equity (25%), Sustainable Equity (25%) and Equity Elite Opportunities (20%) as 4 fund options in the strategy.

The strategy ensured that his funds were rebalanced in the proportion mentioned by him every 6 months to enhance his savings.

At the end of policy term, he will receive a fund value of and help him achieve his goals.

We have answered the most common questions about IndiaFirst Life Radiance Smart Invest Plan. Learn more about how this plan can work for you!

| Parameters | Minimum | Maximum |

|---|---|---|

| Age at Entry | (91 days) 0 years for Plan Option 1 18 years for Plan Option 2 & 3 | 65 years for all Plan Options |

| Age at Maturity | 18 years | 99 years |

| Parameters | Minimum | Maximum |

|---|---|---|

| Regular pay | 10 years | 99 - Age at Entry 99 - years for Life Plan Option 81 years for Extra shield & Family care option |

| Limited pay | 10 years 15 years 20 years 25 years |

20 years 20 years 30 years 30 years |

| Single pay | 10 years | 34 years |

| PPT | Minimum Policy Term |

|---|---|

| 5 | 10 |

| 7 | 10 |

| 10 | 15 |

| 15 | 20 |

| 20 | 25 |

| Annualized Premium (RP/ LP) | Single Pay |

|---|---|

| INR 48,000 | INR 2,50,000 |

You can choose the option of Systematic Partial Withdrawal after completion of first 5 policy years provided life assured is 18 years and above. You can choose this option either at the proposal stage or place a subsequent request after policy issuance. In either scenario, you need to choose the percentage of pay out and meet viability conditions as follows:

The systematic partial withdrawal amount should not be less than Rs.1000 and not more than 20% p.a. of the fund value at a monthly, quarterly, half-yearly or yearly frequency after completion of first 5 policy years. The fund value should not fall below 110% of one annual premium for regular/limited premium paying policies and should not fall below Rs. 100,000 for single premium at any time during the tenure of Systematic Partial Withdrawal assuming a gross investment return of 4% p.a, provided premiums are paid as and when due.

You can choose the option of Systematic Partial Withdrawal after completion of first 5 policy years.

18 years and above

Tax benefits may be available as per prevailing tax laws.